Investing in commercial real estate for your business, whether it is a start-up or is well-established, is a momentous decision in a business owner’s life. From the moment you select and establish your business in a certain space, it becomes one of its biggest defining factors.

While looking into the commercial real estate sector, one of the first major decisions you will have to make is whether you are looking to buy or lease the property. Buying commercial real estate entails that you will either pay the entire purchase price in lumpsum or via a loan over an extended period. Leasing on the other hand signifies when a commercial property is rented for an agreed period of time, with periodic payments throughout the leasing period.

Whether you choose to buy or lease the office spaces hinges on numerous factors such as your current access to capital, your business needs, whether you’re a new business or a flourishing one, organizational goals, and projected growth. New business owners for instance usually prefer leasing rather than owning the property owing to the exorbitant down payment on commercial property. Your decision is thus to be made keeping in mind the business’s vision.

To ensure that you make the optimal decision befitting your organisational needs, we have curated a listicle to help you make this crucial decision.

- Financial Outlook: When you buy a commercial property, you are entitled to 100% of the ownership shares, which helps in building the value of your business over time. Not only that, commercial property usually appreciates over time, subject to demand, inflation, and other market dynamics of the time. This allows the business owner to enjoy the flexibility of selling or leasing the property when it is time to move to a different location or in case of the business underperforming. Also, the owner of the commercial land parcel can rent a part of the property to the likes of recreational and retail avenues, while utilising the rest for his business needs, thus generating a steady source of secondary income.On the other hand, when a property is leased, you are not entitled to any equity share nor can you earn rental yield. Also, with the appreciation of the office space, rents are liable to increase once the lease agreement expires.

- Liquidity: Another important aspect that will tip the scale of the decision between leasing and owning is the liquidity factor. Owning an office space requires large capital investment upfront, whether you decide to pay the entire property price or choose the loan route that still requires you to pay a hefty downpayment. This may lead to a significant proportion of your capital being tied up, thus unable for usage for other business needs like expansion. This may become a huge obstacle for new business owners, who are still in the process of building up a steady revenue stream. For them, leasing an office space enables them to carry out their business operation, with only the periodic rental payment expenditure to contend with.

- Control vs Flexibility: Owning the office space your company is working out of, lends you a greater sense of control over how day-to-day operations are carried out in the organization, without any restrictions on the landlord’s end. Further, your vision for the company’s layout and design can be configured so that the space becomes an extended identity and in essence a branding tool for your business. On the other hand, leasing a space restricts following the tenets laid down by the landlord. However, leasing office space does lend flexibility in major areas of concern. For instance, leasing renders you with the advantageous ability to place your company in the midst of prime business locales on a relatively lower capital investment. Not only that but it also ensures an easy transition to a new locale once the lease agreement ends.

- Overhead Expenditure: If you hold ownership of your workspace, then you are responsible for tending to not only the business operations of the enterprise but for the day-to-day maintenance and operation of the workspace as well. This includes but is not limited to overseeing everything from the structural integrity of the office space to property upkeep. In contrast, leasing a commercial property liberates you from most of these responsibilities, with the onus being on the landlord and thus allowing you to channel all your energy towards the core business activities.

An astute investor ensures to conduct thorough research on the market dynamics, location, and industry trends. Thereby the inception of a curated and exhaustive business plan outlining the strategy, objectives, and vision of the enterprise is developed. Only by taking into consideration all of these factors can a providential decision regarding leasing or owning office space can be made.

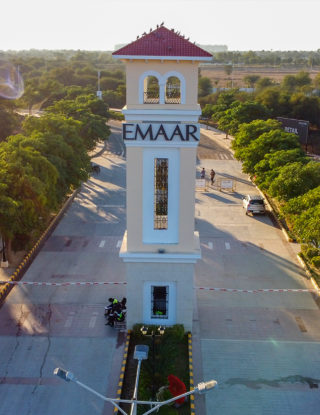

The real estate virtuoso, Emaar is cognizant of the augmenting need for ultra-modern office spaces, that facilitate employee performance and productivity. They have therefore meticulously manufactured high-powered business districts in the megacity of Gurgram. Manoeuvring all the advantages of the Millenial City, Emaar aims to provide you with the ideal office space for your business to flourish. Whether you want to buy or lease, at Emaar business district all your business needs are indulged, ensuring a unique and elevated business experience.